We often get asked how to invest in real estate and what investors should be looking for in an income producing property. It can be overwhelming for a first-time investor, as the real estate investment industry is riddled with various scenarios and situations that can decimate your returns. While the returns can be lucrative, proceed with caution.

The geographic boundaries in which you intend to invest will be mostly restricted by whether you intend to outsource property management services or manage the property yourself. If the latter is the desired route, you are going to want to look for properties that are within a relatively close travelling distance. If you are contracting outside property management services, this is less of a factor.

Here are 10 features that investors should evaluate and consider when hunting for that perfect real estate investment property.

1. Employment Opportunities: Locations with a growing job market tend to attract more people. More people means more renters, especially if you target an area with a large rent/own ratio. You can visit Statistics Canada for reliable and timely data on the labour market for the area you are considering. If you notice a large corporation moving to the area, migration will follow. College towns are now also a viable option as there is the steady flow of students needing off-campus housing, although the demand may only be strong for the September to April school year.

2. Location, Location, Location: The quality of the location will influence the type of renters attracted to your rental property. Look at criteria, such as the Walk Score, proximity to transportation, hospitals, proximity to universities and colleges, major business centres, local restaurants and shopping. The more central the location, the greater the demand.

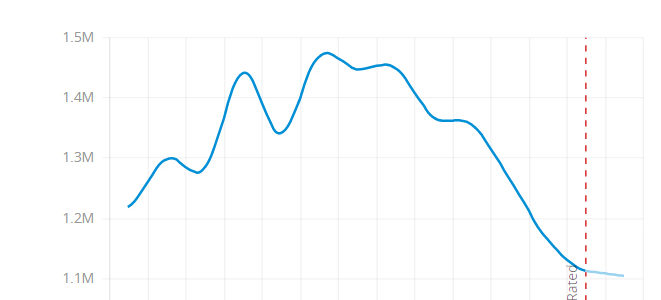

3. Rent: For income properties, your monthly rent is your staple. Find out what the average rental rates are in the area. Can you achieve above or below the average? At the very least, you are going to want to cover your mortgage payment, taxes and miscellaneous expenses like insurance. If this can be achieved, then you can move on.

4. Safety: No one wants to live in an unsafe neighbourhood. You can inquire about crime rates. Again, Statistics Canada is a great resource, and even the local police department can tell you whether the neighbourhood is safe and secure.

5. Amenities: What attractions are nearby that will both be a draw and requirement for renters? Things that must be considered are shopping malls, parks, movie theatres, gyms and access to public transportation.